The bank often specifies an amount on the mortgage, and this is referred to as the “priority amount”. A priority amount is the maximum amount the bank has priority over any subsequent mortgage. Priority amount will be referred to in a loan, and this amount will exceed the actual amount of the loan borrowed from the bank.

In general, the priority amount is usually around 1.5 times of the value of a property. Accepting the priority amount does not necessarily mean this amount is how much you owe to the bank.

The primary purpose of specifying a priority amount is to protect the bank. It gives the bank the right to claim the loan from the borrower in some situations such as mortgagee sale, so that if the borrower does not repay the loan, the bank can fully recover all the money that owed to them.

The bank is the first mortgage, which means the bank is ranked ahead of any subsequent mortgage. If a second mortgage is registered later, their priority amount will be ranked after the first mortgage.

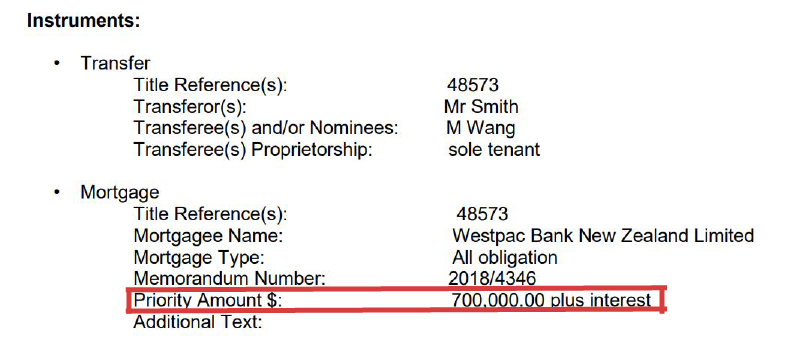

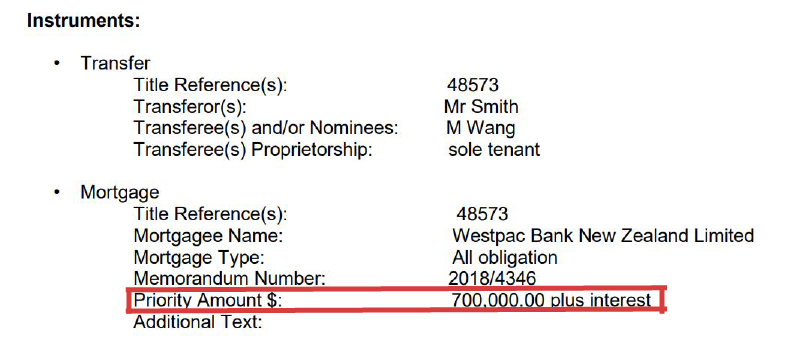

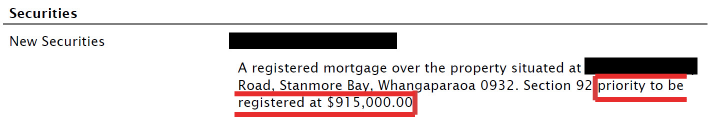

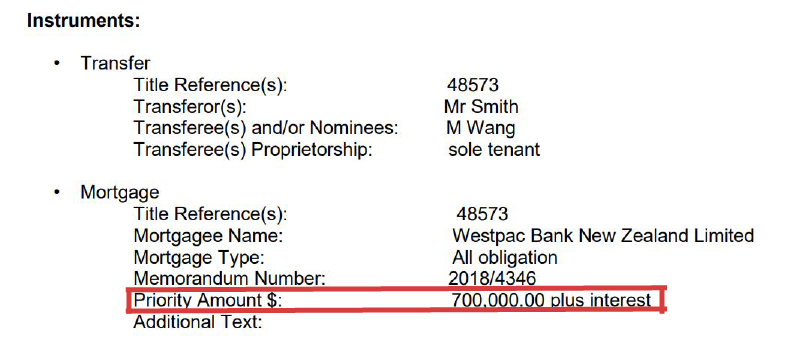

Here is an example of an A&I (Authority & Instruction) form that needs to be signed for transferring the registration of property title before the settlement. This form specifies the priority amount. In this case, Mr.Wang is borrowing the money from Westpac bank. The priority amount, $700,000, is higher than the actual borrowing amount, and this number is around 1.5 times of the property value.

This is to ensure that in the event of Westpac bank into mortgagee sale of the house, Westpac can recover the $500,000 loan plus interest they lend to Mr.Wang and any other creditors were ranked after that $700,000.

Priority amount is just to make sure the bank can be fully recovered from the borrowers by having this priority amount registered as part of the mortgage. The inclusion of priority amount shouldn't be of immediate concern. Remember that the priority amount is not the amount that the bank lends to you.

In most of cases, especially for a residential property loan, you don't need to worry about it because you can only get one mortgage from one bank. But for a commercial loan, it’s a different story.

What’s more, if you need to top up in the future, the inclusion of a higher priority amount will give you convenience because you don't need to see your lawyer to update the priority amount. That’s why sometimes the bank allow a bigger priority amount in some situations.

Joy is an associate at Turner Hopkins. She is very experienced in a broad range of legal matters. She has extensive expertise in commercial and property law. Feel free to contact her via call 09 975 2624 or email: joy@turnerhopkins.co.nz

Got questions? Or seek help? We’re more than happy to chat. Call us at 09 930 8999 for a chat with one of our mortgage advisors. At Prosperity Finance, we don’t have a one-size-fits-all solution for your home loan. We look at your case, understand your needs and situation then make a tailored solution for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

The loan offer often mentions “priority amount” under section 92. The priority amount appears much higher than the amount that borrowers are borrowing. What does a priority amount mean on a mortgage? Why the priority amount can be higher than the actual borrowing amount?

When receiving a loan offer, some of our clients might get confused about the legal term. That’s why in this video, our guest speaker, Joy Yuan from Turner Hopkins, explained the meaning of priority amount on mortgage and what it means for you.

1. What is a priority amount? - 01:53

2. Why does the bank specify a priority amount that is higher than my actual loan amount? - 02:36

3. Priority amount explained with an example - 03:23

4. What does priority amount mean to you? - 04:34

The bank often specifies an amount on the mortgage, and this is referred to as the “priority amount”. A priority amount is the maximum amount the bank has priority over any subsequent mortgage. Priority amount will be referred to in a loan, and this amount will exceed the actual amount of the loan borrowed from the bank.

In general, the priority amount is usually around 1.5 times of the value of a property. Accepting the priority amount does not necessarily mean this amount is how much you owe to the bank.

The primary purpose of specifying a priority amount is to protect the bank. It gives the bank the right to claim the loan from the borrower in some situations such as mortgagee sale, so that if the borrower does not repay the loan, the bank can fully recover all the money that owed to them.

The bank is the first mortgage, which means the bank is ranked ahead of any subsequent mortgage. If a second mortgage is registered later, their priority amount will be ranked after the first mortgage.

Here is an example of an A&I (Authority & Instruction) form that needs to be signed for transferring the registration of property title before the settlement. This form specifies the priority amount. In this case, Mr.Wang is borrowing the money from Westpac bank. The priority amount, $700,000, is higher than the actual borrowing amount, and this number is around 1.5 times of the property value.

This is to ensure that in the event of Westpac bank into mortgagee sale of the house, Westpac can recover the $500,000 loan plus interest they lend to Mr.Wang and any other creditors were ranked after that $700,000.

Priority amount is just to make sure the bank can be fully recovered from the borrowers by having this priority amount registered as part of the mortgage. The inclusion of priority amount shouldn't be of immediate concern. Remember that the priority amount is not the amount that the bank lends to you.

In most of cases, especially for a residential property loan, you don't need to worry about it because you can only get one mortgage from one bank. But for a commercial loan, it’s a different story.

What’s more, if you need to top up in the future, the inclusion of a higher priority amount will give you convenience because you don't need to see your lawyer to update the priority amount. That’s why sometimes the bank allow a bigger priority amount in some situations.

Joy is an associate at Turner Hopkins. She is very experienced in a broad range of legal matters. She has extensive expertise in commercial and property law. Feel free to contact her via call 09 975 2624 or email: joy@turnerhopkins.co.nz

Got questions? Or seek help? We’re more than happy to chat. Call us at 09 930 8999 for a chat with one of our mortgage advisors. At Prosperity Finance, we don’t have a one-size-fits-all solution for your home loan. We look at your case, understand your needs and situation then make a tailored solution for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

112C Bush Road,

Rosedale, Auckland 0632